Nope. Never. Not going to happen. Won’t happen. Can’t happen. Not true.

Nope. Never. Not going to happen. Won’t happen. Can’t happen. Not true.

It’s truly unbelievable to Jeff and me that smart, competent people can’t embrace the fact that a good major gifts program works and is worth the investment.

These are the people I call the “major gift naysayers.”

No matter what you say to them, they don’t believe it. Then you show them the numbers and make a logical case – and they imply you’ve “cooked the numbers” or are presenting a case that is not totally clear or right.

For instance, we remember the case of the organization that had 25 MGOs. Their major gift program had been going for 15 years. The average value per caseload was $350,000, with total revenue of $8,750,000.

OK, stop here. 15 years of working at it, and the result is a pitiful $8.75 million dollars and an average caseload value per MGO of $350,000. Is there something wrong here? Yep. Now to be clear, the STARTING value of a caseload of $350,000 is good. But after 15 years? Something ain’t right!!

So that’s the context.

We came in to help this organization, and in one year the caseload value went up to $450,000, with total revenue of $11.25 million. The third year it went to a $710,000 average value and total revenue of $17.75 million. Fourth year: $905,000 average value with total revenue of $23 million.

Then a new leader came in who was “cost-focused,” and he canceled the program.

This is a leader who hired a manager who actually parsed out toilet paper and other paper products in their office so there is no significant waste!

You think I’m making this up? Nope. It’s the honest truth.

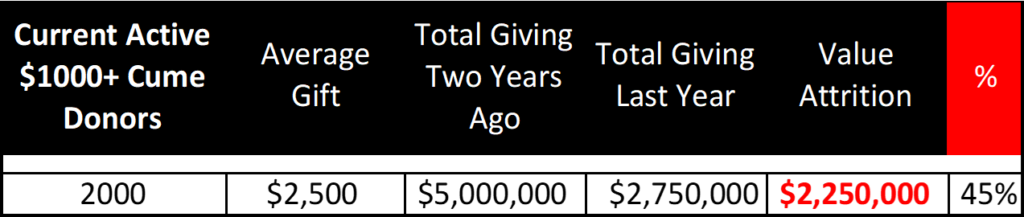

Then there’s another organization whose manager, prior to the program beginning, was shown actual facts about the state of her active donor file. Her file showed that her donors with $1,000+ in cumulative giving had experienced a value attrition of 45% a year!

Let’s get the details down really clearly. They began this period with 2,000 active donors giving $1,000 cume or more in one fiscal 12-month period. The average gift was $2,500. That would be 2,000 donors times $2,500, for a total of five million dollars. That’s what they gave in the first year: $5 million. The next year these same donors gave $2.75 million, or 45% less.

This is what these numbers look like in graphic form:

So we are showing this manager that her organization lost $2.25 million dollars. And it wasn’t one big gift that went away – it was hundreds of donors who either did not give or gave less.

OK, this manager has seen these numbers. And she nods her head that she understands what they mean. She’s no dummy – she has been trained in finance and business in a very prestigious school. You would be impressed with her work history. She is smart!

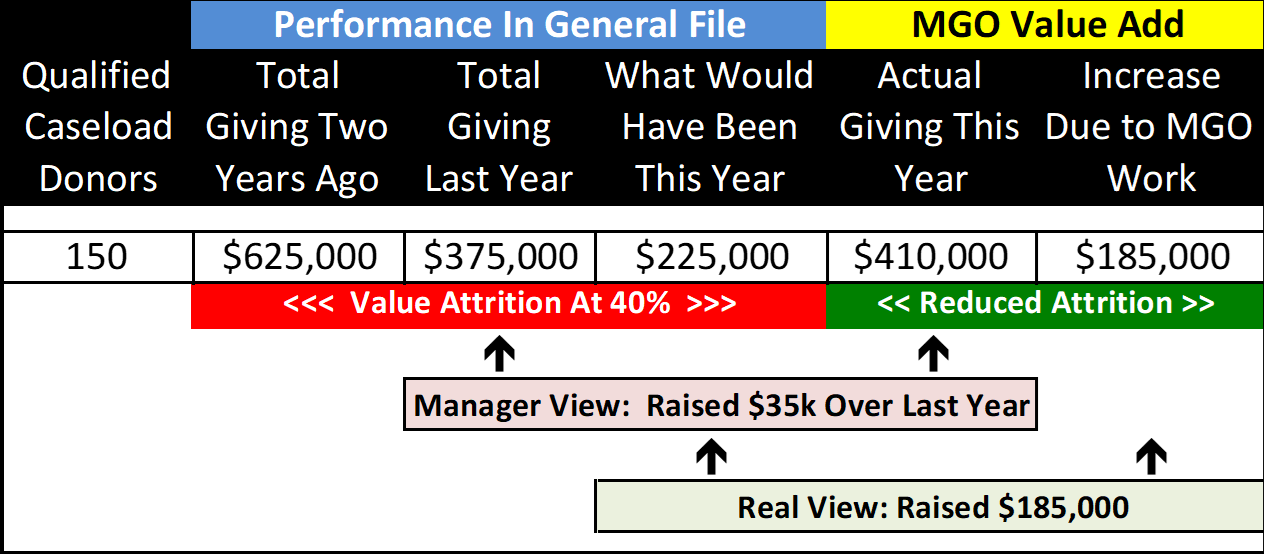

Now we show her 150 donors that the MGO has qualified out of that group of 2,000 donors, along with their performance in the last year since the MGO has been managing them. This is what we showed her:

There are several important points to note on this chart:

There are several important points to note on this chart:

- If the donors had been left in the general file, the value attrition would have continued. So, two years ago this group of donors together gave $625,000. Last year they gave $375,000 and IF they had been left in the general file they would have given $225,000.

- But that is not what happened. The MGO qualified those donors and managed them, and they gave $410,000 this year! That is $185,000 more than they would have given if they had stayed in the general file.

- But the manager doesn’t see it that way. She looks at what they gave last year, ignores the value attrition that has been occurring and says that the MGO has only raised $35,000 more than last year. She is not happy. The MGO only raised $35,000 more than last year? “This is not good,” the manager says. And I am about ready to blow a gasket.

Here’s the thing. Jeff and I, along with our team of professionals, face this kind of discussion/situation all the time. And that is where and why I have come up with the four things I don’t understand about these naysayers:

- How can they, when presented with the facts, ignore the facts? This is probably the hardest thing to process for me. Facts are friendly. And numbers are really friendly. In both cases I presented above, the facts are pretty clear. I don’t understand how someone who works with numbers regularly cannot get either one of them.

- They know personal relationships and connections work, but then they disallow that dynamic in major gifts. You and I both know – and they know – that a personal relationship is a plus in any kind of business involving a transaction of money for goods or services. And in major gifts we all know for a fact that if a donor has agreed to a relationship with a MGO (that’s what qualified means) then that relationship factually causes retention, and giving increases. I don’t get it.

Then there are two other things that we have experienced in our journey with managers. And they add to my list of four things I do not understand:

- They don’t track the money properly, but then they blame the MGO for not doing his job. The job of the MGO is to secure the funds through mutually satisfying relationships. It is not his job to put those gifts in the right finance categories. It always amazes Jeff and me that a finance person or any executive will say that major gifts is cannibalizing some other revenue source when they haven’t set up the system to actually track it and categorize it. I just do not understand that.

- They want “new” money from donors, but they won’t credit the “found” money to the MGO. This is to my point above about the MGO who actually retained giving from the same donors. In my mind, that MGO “found” the money that would have been lost if the donors had stayed in the general file. In other words, those 150 donors gave $375,000 last year and would have given $225,000 this year if they had been left in the general file. But the MGO “found” or retained $150,000 ($375,000-$225,00) PLUS secured an additional $35,000 dollars for a total of $410,000 from those donors! A truly exceptional feat. But the manager will not allow that that actually happened. I am totally in the dark on this one. Can’t understand it.

What I have figured out about all of this: I have to stop trying to understand these things. So do you. But you can do something about it. Here are my suggestions:

- As often as you can, present the facts to those around you – the facts that value attrition is a real thing. Work with your direct marketing or donor database person to produce reports, and spread these facts around. Help managers and leaders understand that this is really happening. (We’d be happy to help you with a free analysis of your file.)

- Keep showing managers and leaders how you are retaining your caseload donor revenue. And how you’re upgrading them. It is a simple exercise to do. Just look at your caseload giving last year, and then a full twelve months later, to capture your value retention. If there is some very large gift in either year’s numbers you will need to take that out, as it skews the results. What you want to show is how most (if not all) of your caseload donors are giving either the same or more than they did last year.

- Focus on all the good things your work is accomplishing in our world. Whereas the first two points above are hard factual data needed for certain people, this is the softer and inner side on how to deal with this. There is a lot of good that is happening because of you and your work. Keep this truth close to you. It is important.

Richard

Thanks for a good reflection of the challenges facing any MGO. I see a lot of truth in the analysis as well as the usual points the “naysayers” make.

This is one of the best articles I’ve read in a long time. Thank you for illustrating your points so well.