There is nothing that causes a bigger debate in the major gift business, next to who gets credit, than the subject of old money/new money.

A couple of months ago I was meeting with a CEO of a very large non-profit. He got so heated in his discussion with me on this topic that he got up from behind his desk, walked around to get closer to me, pointed his finger in my face and said, “Richard, all I want is new money from those MGOs! NEW Money!” And what he meant by new money was money above what the donor had given before.

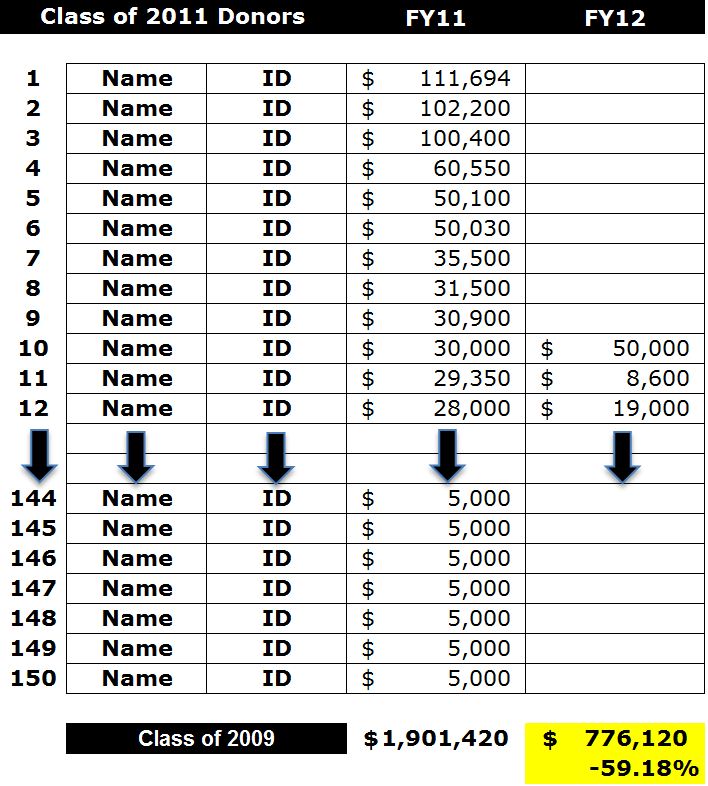

So, I pulled out the chart below and said, “Ralph (not his real name), take a look at this chart. Here are 150 donors that gave $1.9 million the year before and last year gave only a little under $800,000 for a value lost of $1.1 million dollars!! You actually lost over 59% value from these donors. Don’t you think that if the MGO recovered some of that $1.1 million that you lost, it could be considered new money?”

“Nope, Richard. That won’t do,” he said. “I want NEW money!”

Goodness. Am I missing something here? The man has just lost $1.1 million dollars and it doesn’t matter to him if we recover even half of it? Something is wrong here.

And here is how this whole topic boils down to just a few points:

- Most management and finance folks don’t know that value attrition (the money we get from the same donors from year to year) runs from 40-60% for those donors that are not regularly managed and touched. This means that hundreds of thousands of dollars, often millions, are just slipping out the door. I hope you understand what I am saying here. The same donors are giving 40-60% LESS in just one year!

- These same people don’t understand that an MGO, by managing the caseload, can bring that loss to practically nothing. Jeff and I are happy if the loss is just cut in half. In other words, in the example above, if by managing the donors the MGO could recover just half of the $1.1 million lost, that would be an achievement.

- This reduction of the loss is what we call “found” money. While it is different than “new” money, which is money above and beyond what the donor has given previously, it still, in our opinion, is the same as new money. We would not have it in our possession had we not managed the relationship.

- Therefore, an MGO, through his or her efforts, contributes in two ways: (a) recovering lost money, and (b) finding new money. Jeff and I believe that this is how an MGO’s performance should be measured.

So, as you are going about your business today, take pleasure and fulfillment in knowing that as you touch a donor, through various “moves”, you are retaining money that otherwise would have been lost. This is an actual fact that has economic value.

And it is something that very few people know and appreciate.

Richard

0 Comments