Look at it this way. Your donor file has 1,800 active major donors who have given, on average, $3,600 cumulative a year. Only one out of every three of those donors will choose to relate personally to someone in your organization. So, focus on 600 of those donors for the sake of this example.

Those 600 donors gave $2.16 million in revenue in their first year as major donors. But because this group of people gave less year-over-year (value attrition), this cohort of donors lost $928,800 of that $2.16 million in the following year. That’s a 43% loss, which is at the low end of the range we often see in all the studies we’ve done of unmanaged donors, a range of 40-60% loss.

But let’s be conservative and say this cohort lost $928,800. This isn’t a pretty picture, is it? No, it isn’t.

But there’s good news.

If you hire 4 major gift officers to manage the entire group of 600 donors (150 donors each), you can reduce the loss to around $216,000, or about 10% – which is on the high end of the loss range we often see in groups of well-managed donors, 8-11%. That means you would “save,” from this same group of donors, $716,800!!

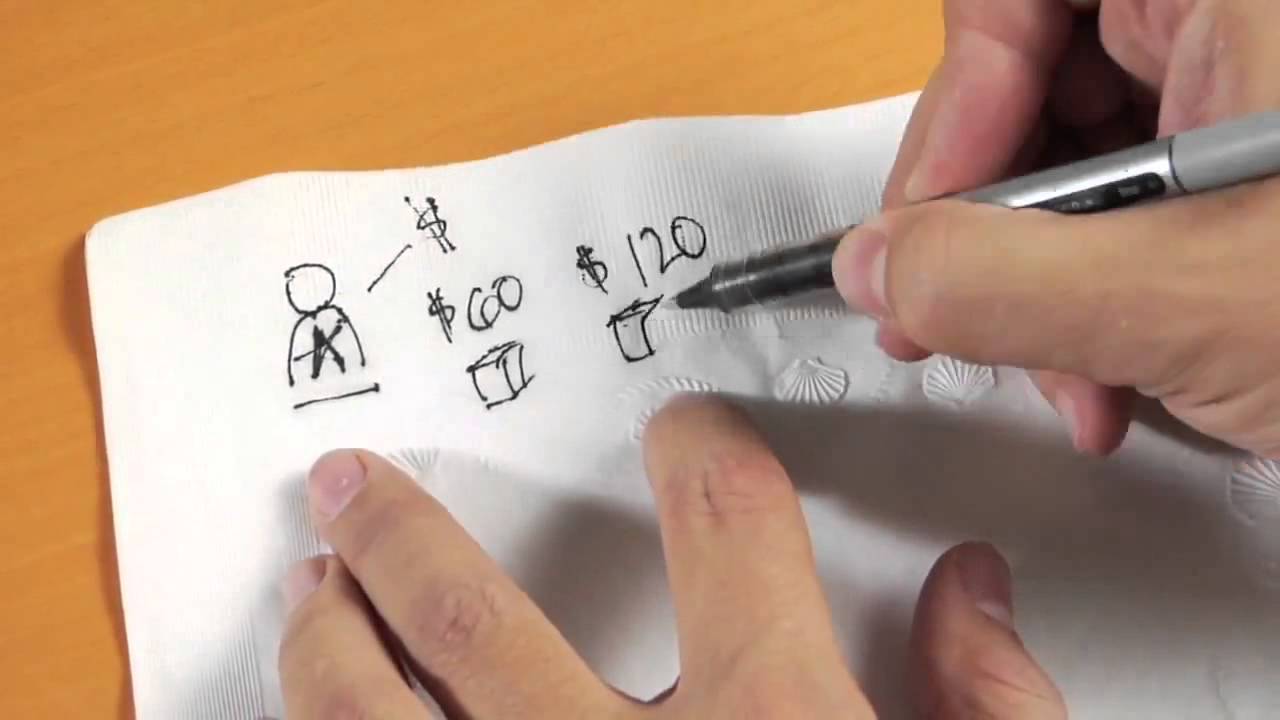

Let’s say that the cost of those four major gift officers is $150,000 each. That’s compensation, benefits, operating expenses, etc. – a total cost of $600,000. Again, this is on the high side, in order to be conservative.

All of this math means that from the money the organization was going to lose (the $928,800 above), they actually lost nothing (in fact they gained $116,800), and also hired four major gift officers!! Here’s the math:

-

Total original loss: $928,800 Loss reduced to: $216,000 Savings: $716,800 Cost of 4 MGOs: ($600,000) Gain: $116,800

If this scenario were true for you, would you hire the four major gift officers? Most people would say no. Why? Because:

- They don’t know how this all works, like we’ve spelled out here.

- They don’t believe the numbers, formulas and equations we’re publishing here, even though it comes from years and years of experience.

- They don’t think the ratio of return on investment in the first year of the major gift officer’s performance is acceptable. That would be the cost of $600,000 against the revenue of $716,800.

- They don’t realize that the revenue per donor will rise from $3,600 the first year to $4,300 the next year to $5,200 the third, and so on up to $6,500 to $7,000 per donor per year – producing an annual caseload value of $1.05 million or more. And all of these are conservative numbers, yet numbers and returns that are still worth it. They don’t know this.

For all of these reasons, authority figures are scared of adding the staff. So they don’t do it, preferring to lose just under a million dollars every year.

Crazy, isn’t it? And it doesn’t make sense. The fact is that multiple millions of dollars are lost every year because of a lack of understanding of the economics of major gifts. Will you be one of those people that is afraid to add major gift officers to your staff? Or will you take the leap and just do it?

Richard

PS — Our course “The Economics of the Major Gift Pipeline” starts next week. If this subject interests you, please join us!

0 Comments