First in a Five-part Series: How to Manage Your Portfolio Effectively

Are you worried about your major donor portfolio’s donor retention rates? Are you concerned that your donor value attrition rates are too high?

You should be.

Over the years that Veritus has done data assessments on hundreds of major gift files, we have seen an unacceptable level of donor value attrition across the non-profit industry. We’ve witnessed tens of thousands to tens of millions of dollars simply going away in major donor portfolios every year, because the same group of donors will give less in subsequent years.

It doesn’t have to be that way. You see, Richard and I believe that if you are properly managing your major donor portfolio you can not only increase donor retention and reduce donor value attrition greatly, but over time, you can massively increase overall revenue and the strength of that portfolio of yours.

But it takes a systematic and disciplined approach to make that happen. Unfortunately, you and many of your colleagues may not want to hear this. Or you may accept the fact that this is true, but you lack the discipline or desire to do it.

I totally understand that. Creating a real structure around your portfolio takes a lot of time and work. There is usually pressure on you from leadership to quickly “get the money in the door.” That shadow of pressure lurking over you has the ability to make you forget the necessary work it takes to manage your portfolio properly.

Quite frankly, it can feel like you are just spinning your wheels when you are taking the proper time to create and implement that structure with your portfolio, because it makes you focus inward for a time.

I get all that. But the truth is that you have to spend this time creating the proper structure, or you will get lost very quickly. The result of being lost without structure is high donor and donor value attrition rates, and a continued reliance of new donors coming into your caseload to “fill up” your portfolio. This means your major gift program will remain flat – or worse, it will decline in revenue.

This is why I created a five-part series on managing your caseload properly. Here is how I’m going to break it down:

- First, I’m going to talk about the overall importance of tiering your file. I’ll get into that here in a bit.

- Then I’ll write about how to work with each Tier, starting with A.

- The final post in this series will focus on how to strengthen your portfolio over time, and what the indicators are for donors who need to move in and out of your portfolio. I will also discuss how long-term planning will help drive your overall portfolio strategy toward growth.

Why Tiering is Critical

Over the years, Richard and I have written extensively on the importance of tiering your portfolio. But we believe it’s so essential in managing your portfolio that we continue to write about it.

Here is the truth: not all donors in a major gift portfolio are of equal value. Let me be clear, that doesn’t mean they are not all of equal value as human beings. I have to say that because a lot MGOs get mad at us when we say this. What I’m saying is that not all donors either give the same amount, nor do they have the capacity to give equally. This means that you who are working with a portfolio cannot treat all of your donors with the same amount of time and energy.

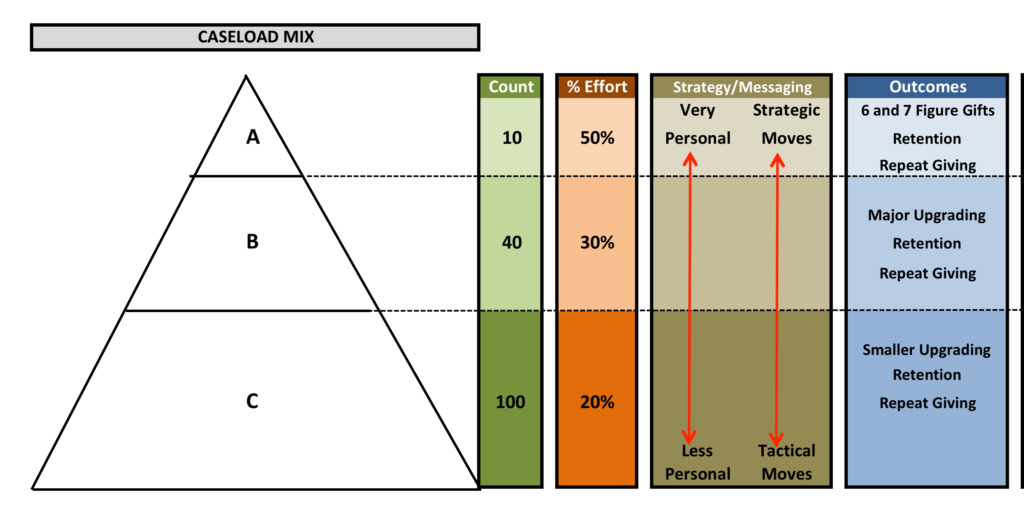

This is just the plain truth, and you have to accept it. This is why you have to tier your portfolio, A-C. Look at the chart below to see how this works visually:

This represents one type of portfolio. I’m going to use this chart in subsequent posts when I discuss each tier in depth, but for now, notice how the entire portfolio is broken out. Of the 150 donors, 10 are A’s, 40 are B’s and 100 are C’s. In other portfolios I’ve seen 20-25 A’s, 50-B’s and 75-C’s. And of course there are other combinations.

The reality is that in order to effectively manage any size portfolio, you have to break it out by these three levels. Here’s why:

- You don’t have time to treat all donors the same. You have a finite amount of time in your day and week. It is not good stewardship of your organization’s resources to spend as much time on a C-level donor than an A-level donor. You would think this is a no-brainer, but many MGOs get this screwed up, and they take a ton of time chasing smaller gifts.

- The majority of revenue comes from your A-level donors. Because of this truth, the majority of your time (at least 50%) needs to be focused on the donors who produce the most net revenue for your organization.

- Tiering allows you to create smarter and more personal strategies. Without tiering your file, you will end up creating strategies that are either too impersonal (because you are implementing a strategy for your entire portfolio), or you will create too much personalized strategy that it’s almost impossible to implement with an entire caseload of 150 donors, and you’ll be less effective. Tiering helps you focus your strategy appropriately.

- Tiering creates overall focus. Maintaining focus is probably the hardest thing for any MGO. You are pulled in many directions. You have pressure from all sides. It’s really, really hard to keep yourself disciplined and focused. Tiering is a portfolio strategy that greatly helps you stay on track and help you spend your time on the right stuff.

I’m not going to go into detail on how to tier your portfolio. Briefly, it’s about recency of gift, the amount of that gift, total lifetime giving, capacity, and what you know about the donor. It’s a bit science and a bit art, but anyone can do it. We’ve helped hundreds of MGOs go through the process, and we know that you will not die. You can do it.

If you want to stop donor and donor-value attrition, creating a disciplined approach to your portfolio through tiering your portfolio is critical. In my next post, we’ll talk specifically about what to do with your “A” level donors, where most of your time is spent every day. It’ll be good.

Jeff

0 Comments