I often am asked the “What should they pay me?” question. And it immediately puts me into a conversation about the role of money in the work of major gifts.

In my introduction to this topic a few days ago I told you that I got caught stealing money when I was in 7th grade. Now I want to tell you why I did it and how it influenced my relationship with, and thoughts about, money.

My parents did not have much money. I didn’t notice it until they sent me to a boarding school for first grade. The school had a mixture of kids from very wealthy families as well as kids like me at the bottom of the economic ladder. It didn’t take me long to notice the difference.

I didn’t know it at the time, but the act of sending me off to a boarding school in another country started me down an emotional and psychological track of self-doubt and loathing. I felt horrible about myself. I was anxious all the time. And I desperately was seeking to discover my value through the kids around me.

While my story is way more complicated than I have time to develop here, the bottom line is that the confluence of my low self-image and rich kids flaunting their money and possessions caused me a great deal of inner turmoil. And so I decided to buy my way into love and acceptance. I began stealing money from the student council store. I did two things with the money: I used it for myself and I gave large sums of it away to a group of friends I was “buying”.

This continued for some time until I was caught and got kicked out of school. The consequences of this childhood event started me on an interesting and dramatic journey with money that taught me several lessons:

- Money has nothing to do with one’s personal value. While I know this intellectually, to this day I still struggle with it emotionally. So I have an ongoing conversation with myself about this to remember that no matter how much or how little I have, I will be no less and no more valuable as a person. And I will be no happier either.

- Money will not help you find or maintain a relationship – any kind of relationship, business or personal. When you have money, like I did at that school and like I have had in my career, there will be quite a few people who are happy to be your “friends”. But if and when the money dries up, you will see most of them quickly disappear.

- Money in the workplace is first about providing service, then about making a living. This one is counterintuitive. We all need to make a living, so work is an important and necessary activity. But I have found that many employers and employees are confused about this dynamic. Over the years that I have been an employer I have found that, with an employee, there is a direct correlation between the employee’s obsession with money and a lack of quality service to the organization. Conversely, those employees who are primarily focused on doing a good job and securing the agreed upon results in an effective and efficient way are the ones who consistently deliver quality services to the organization.

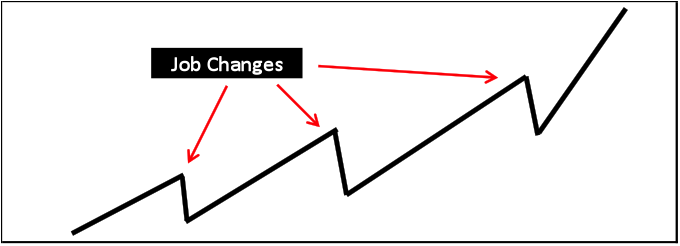

- The acquisition of money needs to be a result, not an objective. I have learned this lesson in two ways throughout my career. The first way is in the progression of positions I have held. Never in my career have I sought a position simply to earn more money. In fact, if you were to look back at my job history over the years, each time I changed jobs, my salary dropped. Why? Because I was seeking a new opportunity and I believed I could make a difference. Here is what my compensation pattern has looked like over the years:

Now, I’m not sharing this to puff myself up or show what a wonderful person I am. I am simply saying that when you approach a job with a motive to secure an opportunity and provide service vs. just grabbing the money, something very magical happens in your heart and your employer’s head. And financial rewards come to you in unexpected and generous ways. Why? Because a good and smart employer will see that he or she has an employee who is making things happen, an employee who is focused on getting things done, and an employee who puts the organization and his or her boss ahead of personal interests. This is very powerful. And in my case, the compensation trend line was up over the years to greater and greater financial rewards with some small “pauses” during transitions.

I know, some of you may have been burned on the compensation thing and are now cynical and careful, saying, “If I don’t take care of me, who will?” I know. But this “if I don’t take care of me” attitude, if not controlled and managed, has a way of putting negative energy into the relationship between you and your employer. Believe me, I know this from being an employer myself and having been an avid student of this topic over the last 25 years.

The second way I learned this lesson is through my work with clients over the years. While it is often said that profits and money come from providing a great product and great service, very few people actually believe this principle and put it into action. Instead, they are obsessed with grabbing the money. The result? They set a tone in their organization that is self-interested and self- focused rather than others-oriented. This is a dreadful mistake and one that leads to failure.

When you lead an organization that is providing services to customers and you honestly believe you can take short cuts, put yourself before others, and manipulate and lie in order to get what you want, you will fail. It is just that simple and it is only a matter of time before reality catches up with you.

Conversely, if you serve your employees and your customers outrageously, with a heart and mind toward their interests, the financial rewards will follow. I have experienced this principle in the organizations I have owned and led in my career. And it works. It really does.

So, what does all of this mean to you in your current major gifts job and/or your search for a new job? How should you think about money/compensation in your work? Here is what I think:

- Adopt a philosophy of service vs. just going for the money. Have a heart and mind that is oriented toward giving vs. getting. This means asking yourself why you are so obsessed with money, if you are. You only need so much. Why are you obsessed with wanting more? I am not saying here that you shouldn’t want more or plan to get more. I am asking why the wanting is so central to your being? I have nothing against making money. It’s fine with me if you go for the $150,000 job or you have discovered a way to make millions. My question is about your heart and your motives. If the core driver is just about the money, you will not have a good journey. If, instead, it is about good service to others, you will be successful.

- Do not let your drive to want more money force you into a job situation that won’t work. If you absolutely need (not want) to make $40,000 but the job pays $35,000, don’t maneuver yourself into a situation in which you persuade the prospective employer to give you $40k. It will set the wrong tone and the wrong expectations. It will put pressure on you that you do not need. If what you need is $50,000 and the range of the job is $50 to $60k, why not start at the $50k and “win” the rest of it through good service? Why do you HAVE to have more to begin with? The point here is simply this: do not make money the driving and central force in taking a job. Do not let yourself get beyond your needs into wants. Let your service be the thing that brings you the money, not your manipulations.

- Be aware of and own the fact that your employer needs an economic payback from the money he or she is investing in you. We hardly ever think of this point – that the employer needs to get something from the deal as well. He or she not only needs to get work done – somehow it needs to be economically worth it. In major gifts, if you are just starting out, the payback may be as low as 1:2 or 1: 3, meaning the organization gets back $2 or $3 for every dollar they spend. As the program matures, that ratio needs to improve substantially. If YOU own this and serve it, you will bring joy to your manager. And I know that when this kind of joy happens, financial rewards for you are just around the corner. That is how it works.

- Be willing to take a step backwards financially in order to secure a better place for yourself. Assuming you are taking care of your financial needs (not wants), when you are thinking about changing jobs or doing the same thing in another organization, think of the opportunity first, not the money. And if the opportunity is something that really matches your motivations and abilities, but the starting pay is below what you make now, but above what you need, then strongly consider it. I promise that in this situation, the money will take care of itself.

What this entire post comes down to is this: Focus on giving of yourself vs. trying to get. If you can do this, you will find true happiness. Then all you have to do is sit back and watch what happens.

Richard

Thanks so much for this honest post. In fact, I love all of your posts and this one just moved me to comment. Keep it up!

Thanks, Stephanie. I appreciate you comments and your encouragement!