There is a friendly debate going on between an MGO, with a great deal of experience, and me. The subject is about the use of receipt returns in major gifts – that tiny tear-off “coupon” that is attached to the official receipt that goes to a donor.

The discussion started because a few of us were sitting around one day trying to figure out where direct marketing techniques end, in the management of a major donor file, and where classic major gift strategies begin.

There are a lot of things one can talk about on this subject, but our specific conversation migrated to the topic of receipt returns in the context of a major donor relationship.

We had all agreed that receipt returns serve the useful purpose of encouraging additional gifts from donors. But where we got into a bit of conflict centered on the answer to this question: “How big of a gift has to happen before it is just downright impractical, or maybe even abusive, to include a return coupon on the official receipt? Is it a $1,000 gift? $5,000? More or less?”

Well, I had to admit that if someone gave $100,000 it might be a little tacky to have a return coupon attached to the receipt. But then, as I thought about it, I said to myself, “Why not? What does it hurt? The donor certainly understands. And it may prompt her to give again.”

But my MGO friend took great exception to that position and said it would actually hurt the relationship.

So, in order to shed some light on this topic, along with some facts, I turned to my good friend and colleague, Jon Van Wyk, donor research and fundraising trends guru who works at TrueSense Marketing, for some answers. Jon is one of our industry’s foremost authorities on donor behavior. What follows is what he said about the topic.

First, some background.

The case Jon presents here is from a chapter-based social service organization. The standard receipt package includes a #10 envelope and 14” form sent with bulk nonprofit postage. Each form includes a letter targeted to the donor, recognizing the gift amount, date and appeal from which it was given (for the donor’s record) and one perf-off panel giving the donor an opportunity to give again with a soft ask (reply device). A Courtesy Reply Envelope is enclosed so the donor can conveniently respond. Receipts are run once a week. This is the type of package we mean when we refer to receipts in this post.

Receipts testing has been conducted for many years. And the hard giving data have always supported the decision to include an ask with the reply device. These findings have been supported by other direct response practitioners through the years as well. It is now considered a part of best practices.

But here we explore two facets of receipt giving.

- First, we look at how donors respond to receipt returns at different levels of the donor pyramid. This is useful for understanding whether a single receipt strategy should serve the entire pyramid.

- Secondly, we examine the effect of receipting on retention. One hypothesis that has gained some notice through the years is that a receipt should be just a thank you. That is, the addition of a reply device and reply envelope neutralizes the goodwill of the package. This point underscores what my MGO friend was saying. It is offensive to put an ask right into the thank you and the receipt.

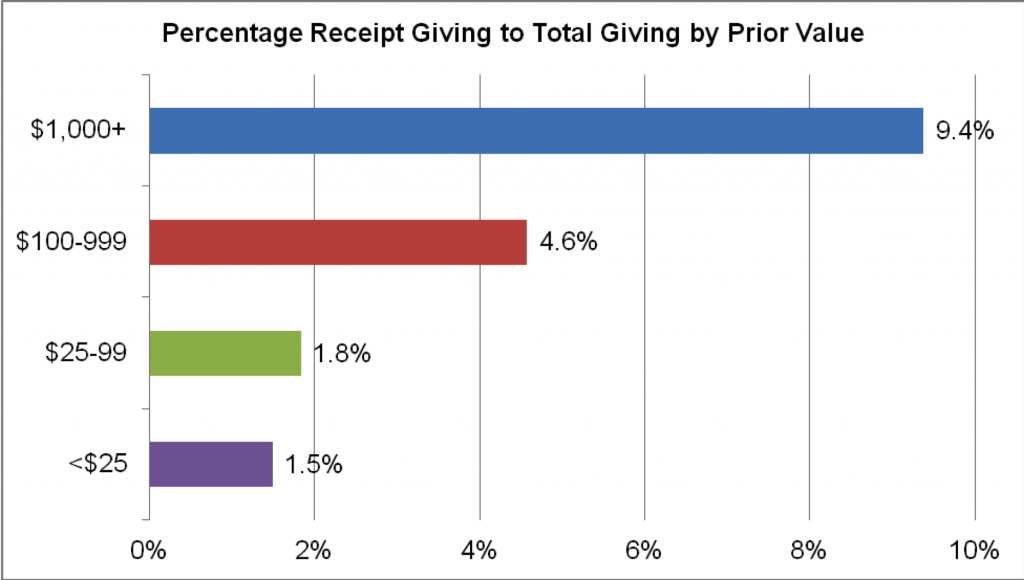

So, the first question to answer is: Should receipts go only for small sum donors, or does it matter? The graph below shows the percentage of a donor’s total giving portfolio that was in response to receipts in 2012 by his or her prior annual cumulative value (2011).

The average across the giving ranges is 3.0%. Donors at the $100-999 level gave to receipts at 1.5 times that proportion. The $1,000+ donors’ receipt giving is more than three times the average. Clearly, the further up the pyramid you move, the more likely the donor favors receipt giving. Hmmmm. That was surprising.

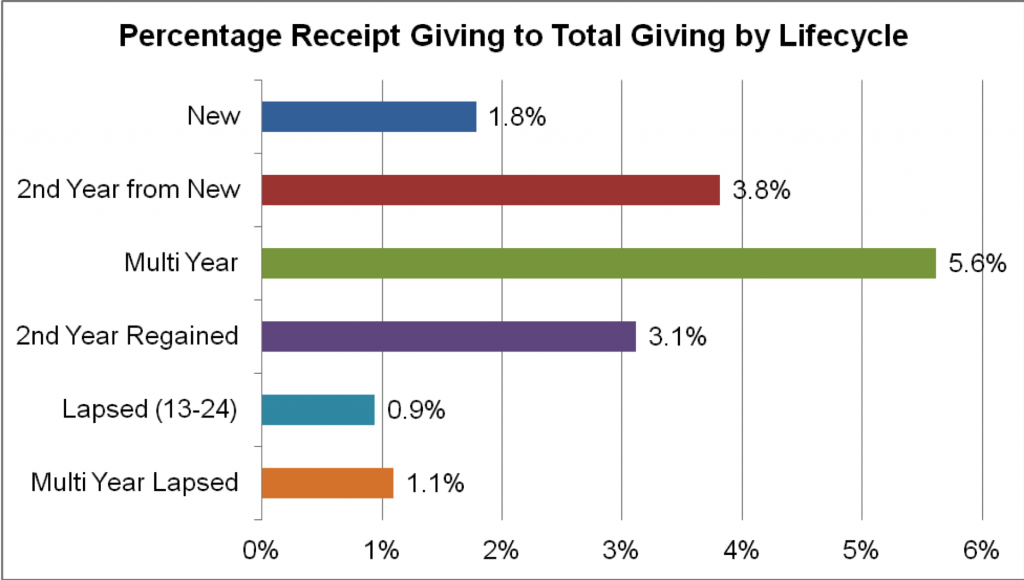

Now look at the next chart. As donors advance up the loyalty lifecycle, they give a higher proportion of their giving to receipts. Goodness! Can this be right?

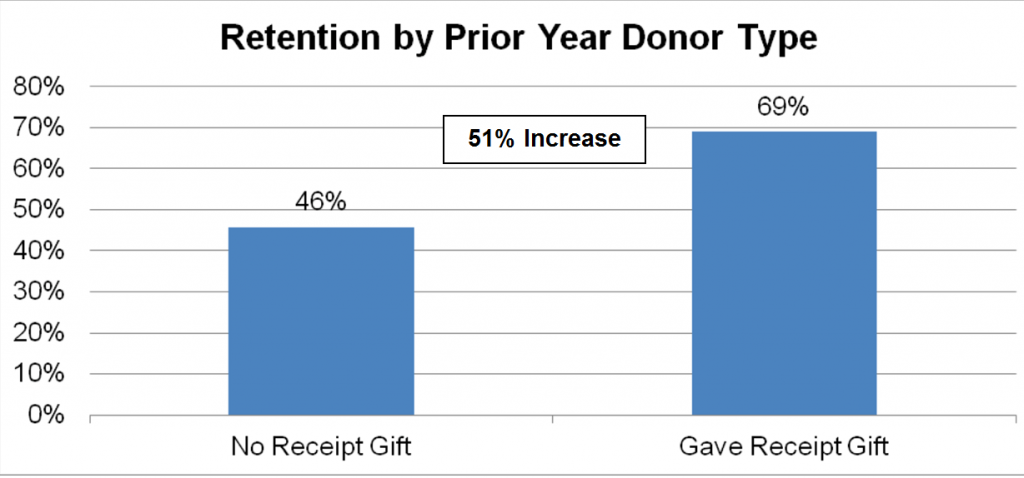

Now to the answer to the second question: How well do receipt givers retain? In the no-ask philosophy, one may say, “Fine, you manipulated a receipt gift from a donor, but you’ve hurt the relationship.” To address this concern we examined the subsequent retention of receipt donors versus those who don’t respond to receipts.

The graph above shows that donors who gave to receipts in 2011 were much more likely to be retained as donors in 2012. In fact, the overall retention of receipt donors is 51% higher than those who didn’t give to receipts.

Goodness! I had an inkling that receipt returns were a good thing, but this information is quite eye opening. I think it is fair to agree with Jon’s conclusion, which essentially suggests that the soft ask in receipts and the giving it generates is a good thing, both for giving and retention.

Now, having said all of that, Jeff and I believe there is a limit to when you should use a receipt return. If a donor gives you $100,000, we don’t think it is appropriate to include a receipt return with the thank you and receipt. Even the circumstances around a $50,000 gift or even $25,000 and possibly a $10,000 gift may suggest the same. And we have talked about this quite a bit.

Supposing, for instance, that you have a donor who just keeps on giving $5000 at a time? Let’s say this donor has tremendous capacity, and $5000 to her would be petty cash to us. Might a receipt return be OK in this situation? Maybe.

So, the principle has to be that it is always good to insert your personal judgment into the equation. We have consistently said that each donor on your caseload needs an individual communication and ask plan. It follows that your knowledge of the donor and your feeling about receipt returns should be applied on an individual donor basis. Do not create a blanket policy.

There is one thing for sure, though. There are many donors that want to and can give again. What strategy do you have in place to encourage that gift that respects the donor? That’s what we want you to think about.

Richard

This post hits on a hotly-debated issue and one that I have been debating with others (including our various consultants who all disagree on this issue) after watching a recent webinar by Penelope Burke, author of donor-centered fundraising. She claims that her recent research again confirms again that effective thank yous are critical to donor retention and that an effective thank you should not include a solcitation. She suggests that any type of ask in a thank you is short-term thinking. Although it brings in dollars, she believes it ultimately leads to attrition. That leaves me with the following questions after your post:

1) Even if receipt givers have higher retention, do you have stats that show whether or not non-receipt givers have higher or lower retention when they receive soft asks in their thank yous. That is, do soft asks in thank yous result in higher overall attrition? It is no surprise that receipt givers have high retention as they seem to usually be your happiest constituents who use the convenient envelope to make a gift. (The same people often use reply envelopes in newsletters to make gifts).

2) With major gift donors, do receipt gifts actually result in larger overall giving? That is, if you gave them a nice thank you that was only a thank you and didn’t oversolicit them with direct mail, would you ultimately get more dollars by relying on a few select asks and having major gift officers make more routine and larger annual giving asks? To really answer this question, you would need to compare two major giving segments that get different treatment over time.

So, this really boils down to whether a higher retention rate by receipt givers is meaningful data.

Great questions, Paul. I will need to go back to Jon Van Wyk for some answers, which I will do and report back on this. So, stand by. Two additional comments/observations:

1. Note that our recommendation is that receipt returns should and can be used for LOWER level major gifts and that each MGO should have a donor driven plan or approach for EACH donor. So we are not recommending a blanket policy or strategy on this topic.

2. I don’t know the answer to this point, but is Penelope Burk’s “research” donor opinions on how they want to be treated or is it data driven? Does anyone know? As you know, in this fundraising business, as in many others, there are a lot of opinions, including ones put forth by Jeff and me. But are those opinions quantified and proven by data? That is what I hope to find out as it will shed good light on this subject. More later.

Paul, some answers here from Jon Van Wyk. First, in response to YOUR question #1:

“The analysis I shared with you looks at donors over a two-year period. I used the first year to establish two groups: 1) those who gave in that year, but not to receipts; and 2) those who gave in that year and their giving includes a gift to receipts. I then used the second year to see how these two groups retained. That’s the graph that you shared in the blog.

The comment about receipt givers being the happiest seems like conjecture. I would go so far as to say that actively giving donors are happier with the org than lapsed donors (see Arthur Brooks), but I wouldn’t claim their level of happiness based on what they gave to without knowing more.

I do hear a call for a true A/B split test to see how the receiving of different receipt approaches impacts giving. That’s the way to solve this scientifically.”

And, as relates to your question #2, I repeat what I said earlier. – higher end donors should be handled in a personal individualized way vs. a blanket policy of receipt returns…