You know how it is. You have this one thing going and it’s working for you. It’s REALLY working. In fact, you’re so mesmerized by how well it’s working that you’ve lost your mind and your sense of reality.

You know how it is. You have this one thing going and it’s working for you. It’s REALLY working. In fact, you’re so mesmerized by how well it’s working that you’ve lost your mind and your sense of reality.

You’ve become a victim of the plague of one source dependency. This is where things are going so well that you don’t see how dangerous it is to be happy with one approach, one solution, one source of revenue.

This COVID crisis has brought this reality home to every non-profit that is overly dependent on events. In many ways, Jeff and I think it’s a blessing that it has. Because it has forced leaders and managers to take a hard look at their dependency in this area and take steps to correct it.

But it’s not only about events. It’s about balance. And a crisis like this is an equalizer that lays bare our personal preferences and judgments about revenue sources and strategies, and it helps all of us think more objectively about how we should do things going forward. This is good.

To help you in revenue source dependency identification, we created a process for you to easily spot your revenue stream weaknesses. This is slightly different from the leaking donor pipeline exercise I talked about in my last post. In that post I was suggesting a way to identify donor pipeline weakness and migration.

Here, the exercise is about looking at your current revenue streams and then making a decision about what to do about:

- An over-dependence on some of your revenue streams.

- The lack of production in some revenue streams.

- Missing revenue streams.

So take some time to jump in and do this exercise. It’s quite simple and, I think, it will shed some light on your path forward in two areas: a short-term look at the revenue shortfall you may experience during this crisis and the identification of revenue stream dependency. OK, here are the steps:

- Make a list of all your current revenue stream strategies. Things such as donor cultivation (direct marketing), mid-level, major gifts, planned gifts, events, grants, fees, etc. Just make sure you identify them all.

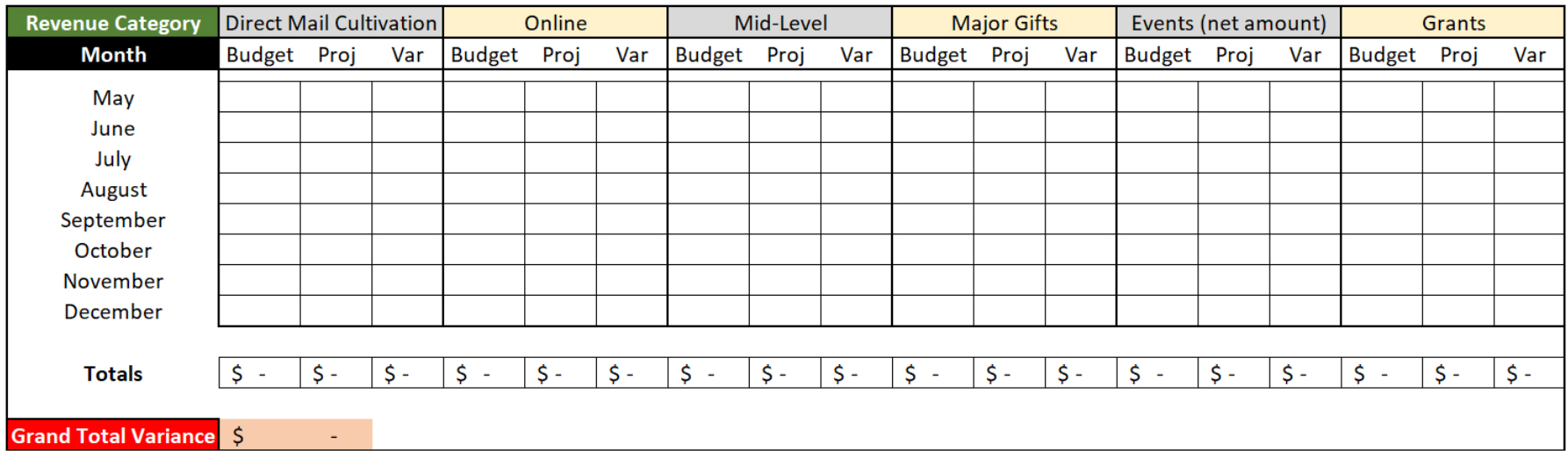

- Put them on a worksheet like the example below. The first column are the months left in this calendar year or whatever financial period you’re looking at. And then, all the revenue streams to the right. You may have to add categories.

- For each revenue stream, list the budget, projected and variance. This gives you a picture of what your shortfall might be during this crisis. And that number is good to talk to your donors about, AND it will inform your judgment about revenue stream dependency. Note that your projection is an estimate of what you think will happen.

- Sum up all your variances. This will give you a number to talk to your donors about, asking them to help your organization cover the shortfall.

Once you’ve done this exercise, it will start to dawn on you what revenue streams are strong and working, and which ones aren’t. And the ones that aren’t might not be working because the strategy is wrong, or there aren’t enough donors (both individual and institutional) feeding that category – which is back to the donor pipeline weakness addressed in my last post.

Once you’ve done this exercise, it will start to dawn on you what revenue streams are strong and working, and which ones aren’t. And the ones that aren’t might not be working because the strategy is wrong, or there aren’t enough donors (both individual and institutional) feeding that category – which is back to the donor pipeline weakness addressed in my last post.

Someone said to me, when seeing this exercise: “I don’t need to do this whole thing. All I have to do is take my budget out and look at the revenue streams and make a judgement about what’s missing, like if there’s one category that is carrying more than 50% of the revenue load.”

That’s true. Two questions to you, sir. Why haven’t you done that? And, this crisis strips away the biases and lays bare the actual truth about what’s working and not working in your environment. So, either way, it forces to you face the cold hard truth about your dependency – which is the whole point.

Take a stab at this. It will be enlightening. And when you couple this work with the pipeline work from my last post, you’ll be well informed and equipped to create a plan to deal with weak pipeline areas and diversification of revenue (the topic I will address in my next post).

One more thing. This kind of work may be tedious and boring to you. I understand. But it’s very important and necessary. Do it because you know it’s important for the future financial health of your organization.

Richard

0 Comments