First in a series: Creating Forecasts and Budget for Major Gifts

Creating a realistic and fair budget for major gifts isn’t difficult IF you know the elements and the principles. And by fair, I mean fair to the MGO and the organization.

But it’s in knowing the elements and principles where things get lost, which is the subject of this three-part blog series:

-

First on creating a major gift forecast.

-

Then, a major gift expense budget.

-

And finally, what to expect in return on investment (ROI) in major gifts.

Before I get started on the forecast piece, I want to lay out some principles you need to follow for major gift revenue and expense budgeting:

-

A forecast should only include revenue from a qualified donor.

-

Every qualified donor has a goal for every fiscal year. The sum of those goals makes up your forecast.

-

Sometimes good donors find themselves in situations where they cannot give as much as they did last year. Allow for that in your forecast. Do NOT just “demand” more.

-

All donor goals should be cash flowed for the 12-month period so that managers can manage internal revenue expectations and info needs.

-

Expense budgets should include all the costs of the MGO – not just salary and benefits.

-

Net revenue and return on investment depend on the life cycle the MGO is in – new, moving toward maturity, mature. Take that into account.

Ok, now to the forecast. I’m going to walk you through how we do it – a process that has been working for decades – and go through the elements and principles behind the process. We cover all of this in our new book It’s Not JUST About the Donor.

As I said earlier, the sum of individual caseload donor goals makes up your revenue forecast. You should never just “add 10-15% to what we raised last year.” Do not, under any circumstance, do this any other way.

Keep in mind that there is a relatively simple yet effective process for forecasting the revenue for a new or existing MGO. But they’re different, because the new MGO is a startup that has its own dynamics and cash flow, whereas the existing MGO is a set program with very slight variations in donor assets. Let’s address each of them separately.

The New MGO Forecast

Before we address the new MGO forecast, it’s important to clearly understand the logic behind adding new MGOs and how that plays into your first- and second-year forecast. There are two steps you should take when adding an MGO:

-

Remember that only 1 of every 3 donors who meet your major gift criteria will want to relate personally. You cannot forecast revenue on donors who do not want to talk to your MGO.

-

Since the total qualified donors on an MGO caseload must not exceed 150, you need at least 450 donors in a caseload “pool” so that, after qualifying the donors, you’ll net out to an approximate caseload size. If you don’t have this, you cannot justify adding a new MGO.

So, let’s say you’ve done your analysis and you have 900 donors who meet the criteria. You have enough donors for two MGOs. Out of 900 donors you’ll usually find 300 qualified donors, which equals two qualified caseloads.

The next step is to calculate the average annual value per donor of that group of donors. For illustration purposes, let’s say it’s $3,400. In other words, those donors, in your last financial period, gave $3,060,000 – (900 donors X $3,400). Hold onto that number, as it will drive the forecast for your new MGO(s).

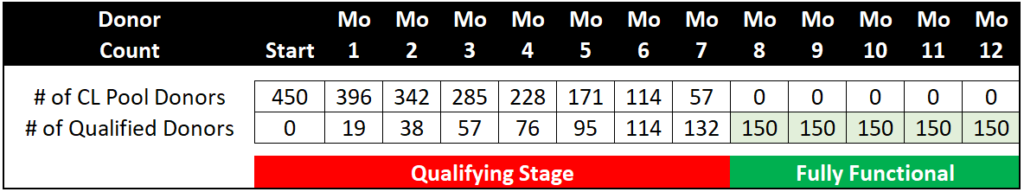

Now you calculate when the new MGO will be fully functional. Remember, and as shown on the graph below, your new MGO needs at least 7 to 8 months, sometimes more or less, to fully qualify her caseload. So, you must allow for that qualification period in your forecast.

Here are the steps to take to forecast your new MGO’s first year revenue:

-

Identify the average annual donor value of the new MGOs caseload pool. In our illustration above we suggested that that value is $3,400.

-

Determine at what point in your financial year the MGO will have reached the fully functional caseload marker. Since it takes at least seven months to qualify 450 caseload pool donors down to a group of 150 qualified donors, you’ll need to find the date that you believe that will happen in your financial year.

Let’s say your financial year is from July 1 to June 30, that you’ve hired an MGO to start July 1, you’ve already done the analysis, and you’ve identified 450 donors who meet the criteria to be in the caseload pool. If all of this is true, then your MGO will not be fully functional until the end of January in your fiscal year.

-

Multiply 150 qualified donors times your average annual value ($3,400) to arrive at a full year value of $510,000. Divide that number by 12 months, which will give you $42,500. Then multiply that number by the 5 months that the MGO will be fully functional which will be $212,500. This is your new MGO’s first year revenue forecast.

When we’ve shared this forecasting formula for the new MGO, some managers have noted that this number doesn’t allow for the higher-than-usual giving in December, and therefore it may be a forecast that is too “rich.” Our counter to that observation is that the MGO does have fully functional donors earlier in the year that aren’t included in the forecast and who are contributing value that offsets December giving.

We build this cushion into the first year forecast to allow for higher-giving months and delays. Don’t be tempted to add this revenue into the forecast. In our experience, you need the cushion in your first year.

The Existing MGO Forecast

For a fully functional MGO, the forecast is different. Here are the steps to take in that situation:

-

Make sure all the MGO’s donors are qualified – If your MGOs are still qualifying and building caseloads, they won’t be able to effectively set goals, nor do we recommend that for unqualified donors. Once a donor is qualified, a goal can be set.

-

Have the MGO review the previous year’s results – Before putting a revenue number to a donor, the MGO must review that donor’s previous giving behavior. They will want to know:

-

Total giving for the last four years – this informs current giving as well as past patterns.

-

Previous largest single gift amounts

-

Previous pledges that have been made

-

Any abnormalities in giving

-

When giving takes place during the year

-

-

The MGO should review donor notes – Great care should be taken in reviewing notes from previous gift officers if the donor is new to the caseload or even their own donor notes. This can help the MGO understand any abnormalities or considerations that should be made regarding donor giving.

-

The MGO should clearly understand potential capacity – Wealth indicator information can be used as a guide, but the MGO must remember that there is a level of inaccuracy associated with these systems. The MGO should also do their own research whenever possible and add to that body of information any personal knowledge they have.

-

Create actual goals for each qualified donor – Once the MGO has all this information, it’s time to put some numbers down on paper. The MGO should consider what a reasonable amount of giving would be for the forecast period for each qualified donor on his or her caseload. They should take into consideration the donor data they’ve collected and any management expectations for growth. They will also need to know when giving from each donor is expected throughout the year for cash flow purposes.

-

Once the MGO has established revenue goals for each donor, it’s time to analyze the total caseload forecast. Does the overall caseload revenue forecast look right in comparison to last year? Does it meet management expectations? Are there any adjustments that should be made? Once the MGO feels confident in a first draft, it’s time for them to collaborate with you as the manager/leader to ensure you’re BOTH in agreement on the goals.

-

Add in stretch goals – Once the budget goals are set, your MGO should develop stretch goals. Stretch goals are designed to help the MGO look for possibilities. Ask your MGO to develop stretch goals for most if not all the donors on his or her caseload. But don’t ask them to share those stretch goals with you. They’re for the MGO, not for management.

Your Total Major Gift Revenue Forecast

You’re now ready to produce your overall major gift revenue budget. You do this by summing up the individual goals from all the MGOs, new and fully functional, as well as MGOs you intend to add in the fiscal year. If you’re aware of any large or transformational gifts that may come in, you could add them to your forecast – although you should err on the side of caution. Remember, an aspirational forecast may or may not happen.

There you have it. An accurate and reality-based major gift revenue forecast. Jeff and I know that most revenue budgets are thrown together by wish and desire of some authority figure. Don’t succumb to that pressure IF you can. You’ll not only miss your forecast, but you’ll spend 12 months of misery trying not to.

Richard

PS – In my next blog, I’ll tackle the major gift expense budget.

Read the series “Creating Major Gift Forecasts and Budgets”

- How to Create an Accurate Major Gift Revenue Forecast (This Post)

- How to Create an Accurate Major Gift Expense Budget

- What Return Should I Expect in Major Gifts?

Fantastic and helpful post. I do then “stretch goal” part a little differently. For every donor there is not only a “forecast,” as you suggest, but also an “ask amount.” I want gift officers to plan their asks donor by donor, taking into account those who are unlikely to make much of an increase this year, those who have some potential, and those who will be asked for large increases, bold special gifts, or transformational gifts. Then when analyzing our performance in our weekly reports we can measure the relationship between *three* significant variables: actual, forecast, and ask amount. That way the “stretch” component is part of our mutual accountabilities and we develop data over time on the relationship between what we are asking and what we actually get. This is an important data point that tells us a lot about our fundraising practice. (The ask amount can change if the initial amount has to be altered because we’ve learned more about the donor and need to change strategy.)

We definitely forecast this way. But what you didn’t address is when leadership and the finance committee want to know what forecasted major gift revenue will be five years down the road…..? I can think of know other way than percentage growth each year.